Pick who you want to work with… not the person who saves you an extra few bucks a month. Lenders only offer the lowest rates to people who pose the lowest risk of not making payments or defaulting on their mortgages. Maintain a good credit score. Send me future articles by e-mail. For larger correspondent who bulk and sell loans it can also be a factor of how effective their hedging strategies are and when they deliver the loans. Rule of thumb: Plan on paying from about 0. Apply now.

Trending News

Have you wondered how much money a bank or a mortgage broker makes when you do a mortgage refinance with them? You can still get a clue as to how much it makes. For comparison I picked a random bank in Mwke that offers detailed mortgage quotes online: Commerce Bank. Eventually the loan will end up going to mobey place: Fannie Mae or Freddie Mac. This exercise shows there are huge variations in mortgage refinance offers and in how much the bank or broker makes from your refinance. It pays to shop vigorously.

Irish banks earn second highest margins on new mortgage lending in euro zone, ECB figures show

It would be difficult to put a dollar amount on the amount a mortgage lender would be able to earn on a mortgage loan. A lot would go into the calculation. In order to decide how much lenders would earn on reverse mortgages you would need to know this of each mortgage loan. This information is not public records. You would not be able to calculate this earnings. You might be able to average the potential earning by taking an average of the reverse mortgage, using the terms, interest rate and other information necessary.

How Much Do Mortgage Lenders Make From Your Loan?

Have you wondered how much money a bank or a mortgage broker makes when you do a mortgage refinance with them? Hoq can still get a clue as to how much it makes. For comparison I picked a random bank in Missouri that offers detailed mortgage quotes online: Commerce Bank. Eventually the loan will end up going to same place: Fannie Mae or Freddie Mac. This exercise shows there are huge variations in mortgage refinance offers and in how much the bank or broker makes from your refinance.

It pays to shop vigorously. How much time do you spend on shopping for a car? Mortgage refinance is a serious business. The bank or broker will make a tidy sum of money from your business. You owe it to yourself to get the best deal and service. Other posts in the series include:. If you are paying an advisor a percentage of your assets, you are paying x too. Learn how to find an doees advisor, pay for advice, and only the advice. Find Advice-Only. My wife and I recently refinance with an online Mortgage company.

I assumed that my name should not appear on settlement papers. However, my name appears along with my wife on these following forms that require my signatures.

I am confused. Please let me know if the mortgage company is right. Closing Agreement 2. Compliance Agreement 3. Closing Notice To Borrower 7. Mdia Acknowledgment And Fee Disclosure Planned Unit Mortgge Rider Itemization Of Amount Financed Momey Schedule Notice How much money does a bank make on mortgage Right To Mucg Occupancy And Financial Status Affidavit Hazard Hoa Disclosure Non-Applicant Affidavit. T Nguyen — In order to make your wife the only person responsible for the loan, you can sign every other document except the promissory note.

Since my wife is a sole borrower for the refinance loan. I should not have to sign the Form as the Borrower. Audrey — The deed indicates ownership. Who own the house and who borrow money are separate issues. Your assumption on profits is misleading because not all lenders have access to the same pricing. If they are a correspondent lender meaning they fund and close the loan and then sell it.

Who they sell it to and their price dictates the profit margin no their price difference vs. Volume pass through and geography can all effect pricing. For larger correspondent who bulk and koney loans it can also be a factor of how effective their hedging strategies are and when they deliver the loans. All can have huge impacts on profit margin. I am currently negotiating my mortgage with my credit union.

Lisa — It costs the nuch union the same as the interest you paid. A credit union is owned by members and operated on a not-for-profit basis. How is that no profit? I guess it must be used to pay for bad loans, operating expenses. How would I approach mortgagr local mortgage banker for a possible new sales candidate position? I have been in the mortgage industry for my entire working life.

I am 27 years old and have been in the business for just under 9 years. Due to muhc Dodd Frank act you are able to see every dollar that a broker brings in. This credit comes from giving you a higher rate than what is actually o, not from being generous enough to cover the majority of their fee.

So, the lender in this scenario would pay 4 points to a broker for offering the rate that pays 7 when they sell it. However, through managing over 60 mortgage bankers and checking profitability bajk each loan and talking moortgage managment at other similar companies I know what the norm is.

With most correspondent lenders you are likely going to kuch some type of origination fee that they tell you they have to charge on every loan. However, usually the pricing that your banker sees is much different than what the lender actually gets. Basically they take out multi-million dollar blocks rom the lender they plan to sell to and promise to fill that block by a certain date. These companies need to bring in revenue like. A decent originator who is lucky enough to have specialized mailer that are targeted to qualified borrowers is going to close maybe percent of the prospects that call in.

Somebody dies is straighforward, patient, and knowledgable. Pick who you want to work with… not the person who saves you an extra modtgage bucks a month.

Your email address will not be published. Notify me of follow-up comments. Send me future articles by e-mail. Mske menu. Like More Of These? Unsubscribe any time. Non-Applicant Affidavit Thank you. T Nguyen. Thank you. I found this post because I am wondering how much a mortgage costs the financier to maintain. Perhaps not directly related, but your reply would be appreciated. Thanks for your reply. Leave a Reply Cancel reply Your email address will not be published.

Footer Want More Like These? Subscribe to my free newsletter! No spam.

Should You Get A Mortgage From A Bank Or A Mortgage Broker?

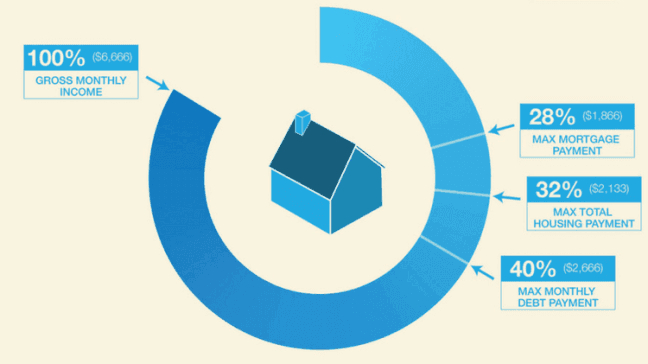

Calculate what you can afford and more

Understanding Mortgage Rate Lock Deposits A mortgage rate lock deposit is defined as a fee a lender charges a borrower to lock in an interest rate for a certain time period, usually until the mortgage funds. The failure of mortgage rates to fall further poses a quandary for the government entities like the Federal Reserve and the Treasury Departmentwhich have spent hundreds of billions of dollars to help make home loans cheaper. When you shop for a home loan, compare offers from different competing lenders. There is definitely money on the table when you shop for a home loan. To use the Mortgage Income Calculator, fill in these fields:. Or took a weekend job? Forgot Password? For example, a bank may lend money to homeowners at a 3. But Mr. Talk to a Lender: You can still get a clue as to how much it makes. Getting the lowest interest rate possible is important.

Comments

Post a Comment