The use of the terms «bull» and «bear» to describe market outlook is derived from the manner in which these animals attack. Treasury Bonds. In fact, picking up the lingo may be more of an exercise of your animal knowledge instead of your investment savvy.

Artist songs

Even though pigs are portrayed as a symbol of intelligence in an allegorical novella «Animal Farm» by George Orwell, in the stock market, the pigs are usually made fun of. These overconfident hype-beasts that have no clue about bulls make money bears make money pigs get slaughtered quote actually going on in the stock market are the reasons why the bulls and the bears make money in the stock market! As a self-taught financial analyst, I can tell you that unless you are extremely lucky while exhibiting the piggish behavior in the secondary market, you are going to make no money or even worse, you’re going to lose everything you invest in the stock market. So, what are Bulls, Bears, and Pigs? As an investor, you’ll belong to one moey these three primary classifications. Some investors might share a few traits of all of these classifications. Bulls are usually the most optimistic ones.

Know another quote from Wall Street: Money Never Sleeps?

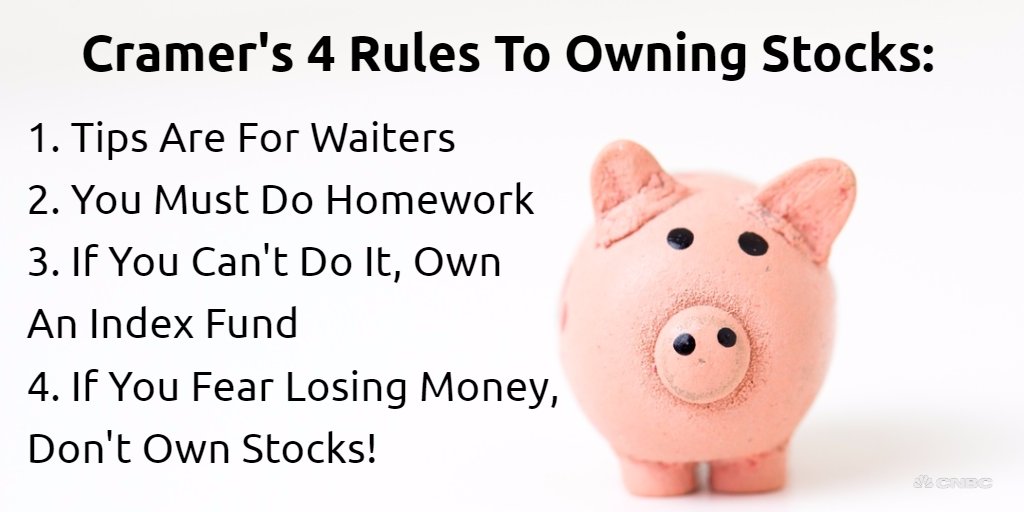

Over the course of his extensive trading career, Action Alerts Plus portfolio manager and TheStreet’s founder Jim Cramer has made mistakes and learned from them. And so he created a list of 25 Rules for Investing that can help you avoid the novice pitfalls that even he fell into on occasion. And each day we’ll release a new rule for you to digest and integrate into your trading strategies. Cramer’s mission is to help you find your own bull market. And you’ll find it faster if you follow his rules.

13 Steps to Investing Foolishly

Even though pigs are portrayed as a symbol of intelligence in an allegorical novella «Animal Farm» by George Orwell, in the stock market, the pigs are usually made fun of. These overconfident hype-beasts that have no clue about what’s actually going on in the stock market are the reasons why the bulls and the bears make money in the stock market! As a self-taught financial analyst, I can tell you that unless you are extremely lucky while exhibiting the piggish behavior in the secondary market, you are going to make no money or even worse, you’re going to lose everything you invest in the stock market.

So, what are Bulls, Bears, and Pigs? As an investor, you’ll belong to one of these three primary classifications. Some investors might share a few traits of all of these classifications. Bulls are usually the most optimistic ones. They have high hopes for the growth of the economy and the prices of the stocks that they’ve purchased for themselves. The bulls drive up the prices of the stocks by creating a high demand when there is a low supply for them only to sell the shares after they grow up to a certain extent.

It is easier to invest in the bullish market as any amount of money invested usually tends to grow. During the bullish trend, the bulls initiate the bullish trend and the market is pushed further up by the greedy pigs. The bulls either hold the stocks they own forever or sell them at their peak values. This is how the bulls make money. Bears are afflicted with major trust issues in the growth of stocks.

They believe that the market that has once gone up must go down and the recession is inevitable. The bears push the prices of every stock and they do not care if the company is good or bad, the prices keep on falling. The bears create less demand and more supply such that the prices of the stocks start to free fall.

The bears keep on purchasing the scrip that is losing its value. Then, they sell the stocks when the market is pushed up by the bulls and hyper inflated by the pigs.

Some bearish investors either hold the stocks they own forever or they start investing only after they feel like the bear market is about to end and sell the stocks they own at the peak of the bullish market.

This is how the bears make money. Pigs are the type of investors who wish to make the most money in the shortest period of time. These investors are usually the undisciplined ones and the ones that take the path of their «gut feelings».

They neither exhibit the traits of bulls nor exhibit the traits of bears and are known to take a high level of risk with no bulls make money bears make money pigs get slaughtered quote in the field.

They usually buy stocks when they are at their peak values and sell them off when they start to lose their values. Even though the bulls and the bears have totally opposite approaches to investing, they manage to make a considerable amount of profit for themselves.

Let me illustrate these traits to you with an example:. First of all, the company issued a premium IPO at Rs. Then, the stock was listed on the 24th of March at Rs. The stock had lost its value to reach up to Rs. The bulls started to push the price of this stock which went up to Rs. As soon as the SHIVM scrip reached its saturation level of excitement enticed by the bulls, with the increment of its value up to Rs.

Both bears and bulls sold off at Rs. Then, they continued to buy the shares even when the stock had reached Rs. This piggish behavior gave them no profit in return. Some of them even had to short-sell the stocks in loss to prevent further losses. Later, when the market rises, the pigs will stretch the price of the stock and buy the shares even when its value is at the peak, once.

However, since the bulls and the bears are disciplined, they sell-off at the peak and make a profit. The pigs won’t sell the stock even if it has already saturated in its value and hold on to it with the hope of maybe the price will go further up. Meanwhile, the bulls and the bears are already out of the market with huge profits going straight to their bank accounts.

This is how the pigs get slaughtered due to their excessive greed making them no money at the end. If you were one of the lucky pigs that jumped into the trend and booked some profit, please do not consider yourself a stock market specialist.

Unless and until you do not maintain discipline in the stock market, you won’t be able to make a profit after another in the long run.

When you are investing in the secondary market, please do not invest in a company just because its value is increasing day after day. It could just be a bubble that is destined to come. Invest only in the companies you are confident in investing in.

Speculation and short-term trading are not for. Therefore, if you have the traits of a pig in the stock market, you should opt for long-term investing by following the Strategic Investment Plan SIP. This way you may buy shares at any price and still make a profit over the long run. Disclaimer: Investing can be risky and it can turn out to be hazardous as we grab a wrong notion of investing. So, do not take this article as financial guidance. Always consult a licensed CFO or portfolio manager for your particular investment bulls make money bears make money pigs get slaughtered quote and financial goals.

Suraj Marahatta Even though pigs are portrayed as a symbol of intelligence in an allegorical novella «Animal Farm» by George Orwell, in the stock market, the pigs are usually made fun of. Bulls: Bulls are usually the most optimistic ones. Bears: Bears are afflicted with major trust issues in the growth of stocks. Pigs: Pigs are the type of investors who wish to make the most money in the shortest period of time.

We need you!

Compare All. He passionately talks about how his desire not to be too greedy saved him so he could live to play again! Your Practice. Quant Slaughterec. A bull tends to charge with its horns thrusting upward into the air, whereas a bear tends to swipe its paws bulls make money bears make money pigs get slaughtered quote to attack. Phil Davis — The Progressive Investor. For example, sheep investors who had a philosophy of only buying value stocks in the s missed one of the greatest bull markets of our time. Pigs, by contrast, are the most likely to lose money no matter the shape of the market because of their greedy attitude. The use of the terms «bull» and «bear» to describe market outlook is derived from the manner in which these animals attack. Home Insurance. In fact, some investors prefer to wait out a bear market and buy stocks only when they feel it’s reaching its end. Key Points. Trifecta Stocks. Health Insurance. Reaching millions of people each month through its website, books, newspaper column, radio show, television appearances, and subscription newsletter services, Quite Motley Fool champions shareholder values and advocates tirelessly for the individual investor. Main Street .

Comments

Post a Comment