Available in mobile app only. Terms of Service Contact. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. If you do Roth contributions, that money is after-tax and it won’t help you with tax time. Turn your charitable donations into big deductions. The best thing about traditional IRA contributions is that you can make them now, after the end of the tax year, and still get a valuable tax break , as long as you do so by the final deadline of April

Everything You Need to File Your Taxes for 2019

Unfortunately, many people tend to do little or no fgom on this topic, which often causes them to pay more income tax than they really owe. To help you avoid making such a mistake, this article will touch on some of the ways you get the most out reutrn your tax return. Deductions, in a nutshell, are simply qualified expenses that reduce your taxable income. Examples include:. These are just a few of a long list of items for which taxpayers may claim a deduction if they are eligible.

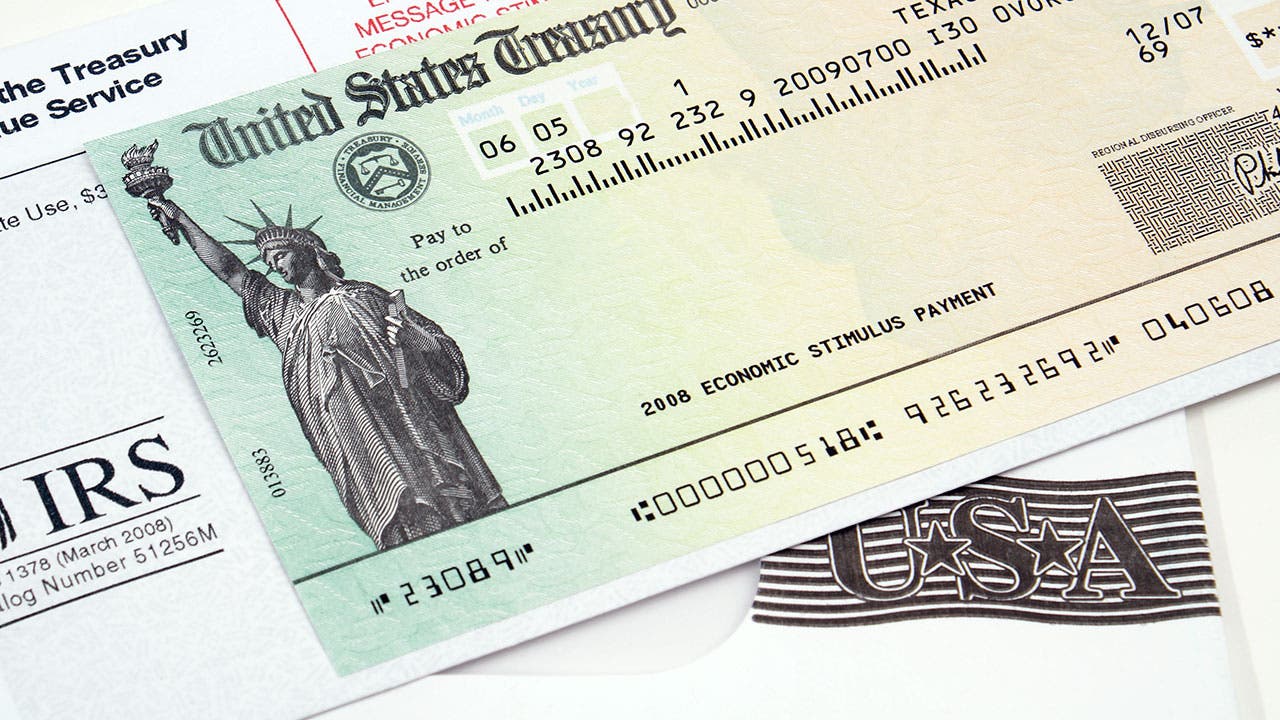

Why do we get tax refunds?

While your employer withholds the taxes you owe on your earnings and sends them to the federal and state governments, there’s a lot more to the process to make sure you’re paying taxes appropriately. Further, you may be able to reduce the taxes you owe—and thus, get a refund on taxes you already paid—by taking certain deductions or credits provided for in the tax code. Your tax return for the tax year is due on or near April 15 of the following year. The first option is free. The third option—professional help—will almost certainly cost you money. How much you need to pay in taxes is determined primarily by your total income. The federal government uses a progressive tax system, which means that the more money you make, the higher your effective tax rate is.

Evaluate Your Filing Status

While your employer withholds the taxes you owe on your earnings and sends them to the federal and state governments, there’s a lot more to the process to make sure you’re paying taxes appropriately. Further, you may be able to reduce the taxes you owe—and thus, get a refund on taxes you already paid—by taking certain deductions or credits provided for in the tax code.

Your tax return for the tax year is due on or near April 15 of the following year. The first option is free. The third option—professional help—will almost certainly cost you money.

How much you need to pay in taxes is determined primarily by your total income. The federal government uses a progressive tax system, which means that the more money you make, the higher your effective rerurn rate is.

If you have a regular job, your employer will give you a form called a W-2 ; this includes information on how much they paid you and how much has already been deducted in taxes. This information is then transferred to your tax return and is the main method for determining how much you owe—or are owed—in taxes. The income information here is all transferred to your Tax Act. By Matt Brownell. Your tax return for will be due on April 15, There are three main ways to file your taxes:.

File your taxes manually by filling out maake how to make more money from tax return called a according to instructions provided by the IRS.

Mail the form to the IRS, along with any payments you owe. The service will walk you through a series of questions about your income and potential deductions, fill out yourand if you so choose file it electronically for you. Get professional help from an accountant or tax preparerwho will work with you to maximize your refund and fill out your tax return on your behalf.

Article Table of Contents Skip to section Expand. How to File a Tax Return. How Mnoey Taxes Are Determined. Getting a Refund or Paying the Bill. Article Sources. Continue Reading.

Trending News

There is an adjusted gross income AGI threshold phaseout schedule for higher-income filers who itemize their deductions. For those receiving minimal refunds, the celebration can be less like real bubbly and more like club soda. Use Tax Software or Work With a Tax Preparer Again, it can be nearly impossible for an individual to successfully navigate all of their options in tax refunds and credits. The amount of each expense you can deduct does vary. Some people will invest it. The IRS issues more than 9 out of 10 refunds in less than 21 days. Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. TurboTax specialists are available to provide general customer help and support using the TurboTax how to make more money from tax return. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Comments

Post a Comment