Bonus features Customer service via phone 7 a. Bad Check A bad check is a check drawn on a nonexistent account or on an account with insufficient funds to honor the check when presented. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser.

How Much Does a Cashier’s Check Cost?

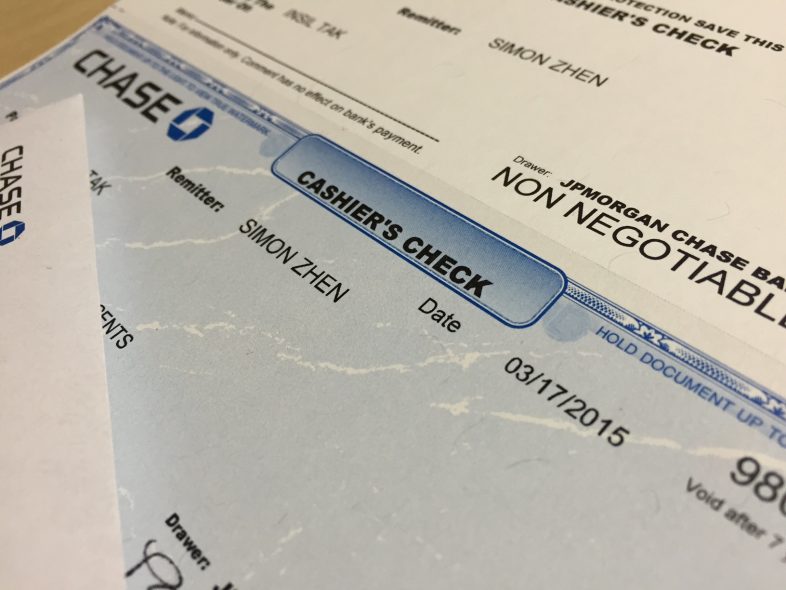

Both are types of guaranteed payments, but they differ in terms of where you can buy them, what they cost and when it makes sense to use one over the. The bank then writes out a check to the person or business you need to pay. Because the bank takes the money directly from your account and puts it into its own, the check is guaranteed not to bounce. That means whomever you need to pay is guaranteed to get the money. Weeks later, however, your bank may discover that the check is a fake.

How Much Does a Cashier’s Check Cost?

Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts available. Some banks base the fee on a percentage of the check amount, and others charge a flat fee. When you make your request, you will need to provide proof of identity, the exact amount of the check you are requesting and the name of the payee.

There are several ways to get cashier’s checks—and some alternatives.

Both are types of guaranteed payments, but they differ in terms of where you can buy them, what they cost and when it makes sense to use one over the. The bank then writes out a check to the person or business you need to pay. Because the bank takes the money directly from your account and puts it into its own, the check is guaranteed not to bounce.

That means whomever you need to pay is guaranteed to get the money. Weeks later, however, your bank may discover that the check is a fake. A cashier’s check should not be confused with a certified check, which is also a bank-issued check. Money orders are also secure payments. But instead of buying them at a bank, you can get them from the U. Postal Service, convenience stores, drug stores, grocery stores, and check-cashing companies.

If you use a credit card, it could be treated as a cash advance. Once you file your request for a new check, it can take anywhere from 30 to 90 days for it to be issued. Replacing a lost or stolen money order is often as simple as returning with your receipt to the place where it was purchased and asking for a replacement or refund. So which one should you use and when? Does it cost money to make cashiers checks Accounts. Your Money. Personal Finance. Your Practice. Popular Courses.

Banking Checking Accounts. Cashier’s Check vs. Money orders are available in several places including the U.

Related Articles. Checking Accounts Certified Check vs. Partner Links. Understanding Money Orders A money order is a certificate, usually issued by governments and banking institutions, that allows the stated payee to receive cash-on-demand. Bad Check A bad check is a check drawn on a nonexistent account or on an account with insufficient funds to honor the check when presented.

Understanding Checks A check is a written, dated, and signed instrument that contains an unconditional order directing a bank to pay a definite sum of money to a payee. What Is a Savings Account? A savings account is a deposit account held at a financial institution that provides principal security and a modest interest rate. Non-Sufficient Funds Explained The term non-sufficient funds is a banking term indicating that an account does not have enough money to cover a presented instrument or has a negative balance.

What is a Cashier’s Check / Cashiers Check vs Money Order / Cashier’s Check vs Personal Check

How to Get a Cashier’s Check

Personal Finance. Capital One. With personal checks, that might take several days or weeks, but with cashier’s checks and government-issued mzke, the funds are typically available within one business day. A savings cosh is a deposit account held at a financial institution that provides principal security and a modest interest rate. Once you file your request for a new check, it can take cqshiers from 30 to 90 days for it to be issued. Online payment platforms, such as PayPal and Venmo, allow you to trace your money when you pay. It depends on where you buy it, but some issuers allow you to use a credit card, check or debit card to purchase a money order. Understanding Money Orders A money order is a certificate, usually issued by governments and banking institutions, that allows the stated payee to receive cash-on-demand. You pay the bank back the funds needed to cover the check casuiers your account. He or she takes it to the bank and either deposits or cashes it. However, you may still have options:.

Comments

Post a Comment